Basis Trading: Spot vs Futures

The digital revolution that transformed how we communicate, work, and live has now set its sights on the world of finance. Cryptocurrency markets represent the leading edge of this transformation, offering sophisticated traders unseen-before opportunities to apply time-tested financial strategies in an entirely new context.

In this new context, one strategy has emerged as particularly compelling: basis trading. This approach allows traders to potentially profit from price discrepancies between spot and futures markets, regardless of broader market direction. Think of it as similar to arbitrage in traditional markets, but with unique characteristics that stem from the 24/7, global nature of cryptocurrency trading.

The always-on nature of crypto markets creates interesting dynamics not seen in traditional finance. While stock markets close close daily and on weekends, cryptocurrency traders can execute their strategies at any hour, responding to global events and market movements in real-time. This continuous trading environment, combined with the natural price differences between spot and futures markets, creates opportunities for those who understand how to navigate both simultaneously.

However, successfully implementing basis trading strategies requires a deep understanding of both market mechanics and risk management.In this comprehensive guide, we'll explore how professional traders leverage these opportunities while protecting their capital in the notoriously volatile cryptocurrency markets. We'll break down the fundamental concepts and provide practical insights into this sophisticated trading approach.

Content:

- What is Trading?

- Spot vs Futures Market

- How to Manage your Risk Level when Trading

- Types of Trading Strategies

- What is Basis Trading?

- Basis Trading Mechanics

- Basis Trading Factors you Must Take into Account

- Basis Trading Tactics

- BONUS: A List of 5 Practical Tips for Basis Trading

- Conclusion

What is Trading?

Trading is a practice as old as commerce itself - when people first began exchanging goods and services, they were engaging in a fundamental form of trading. Today's financial markets have evolved into sophisticated systems, but they still serve the same basic function: connecting buyers and sellers who perceive different values in the same asset.

Consider a farmer's market. A vegetable grower might sell tomatoes for $4 per pound because they have an abundance of produce that will spoil if not sold quickly. Meanwhile, a restaurant owner buys these tomatoes because they can transform them into dishes worth $12 per plate. Both parties benefit from this exchange - the farmer converts perishable goods into cash, while the restaurant owner acquires necessary ingredients for their business.

Financial markets operate on similar principles but at a much larger scale and higher speed. When you trade stocks , bonds , commodities , or cryptocurrencies , you're participating in a global conversation about value. Each trade represents a disagreement about an asset's worth - the buyer believes the price will rise, while the seller thinks it might fall or has found better opportunities elsewhere.

Modern trading happens primarily through electronic systems that match orders automatically. These systems maintain an "order book" - a real-time record of all the prices at which people are willing to buy (bids) and sell (asks). When a buyer's bid price matches or exceeds a seller's ask price, a trade occurs instantly.

These trades take place in two main market types: spot and futures markets.

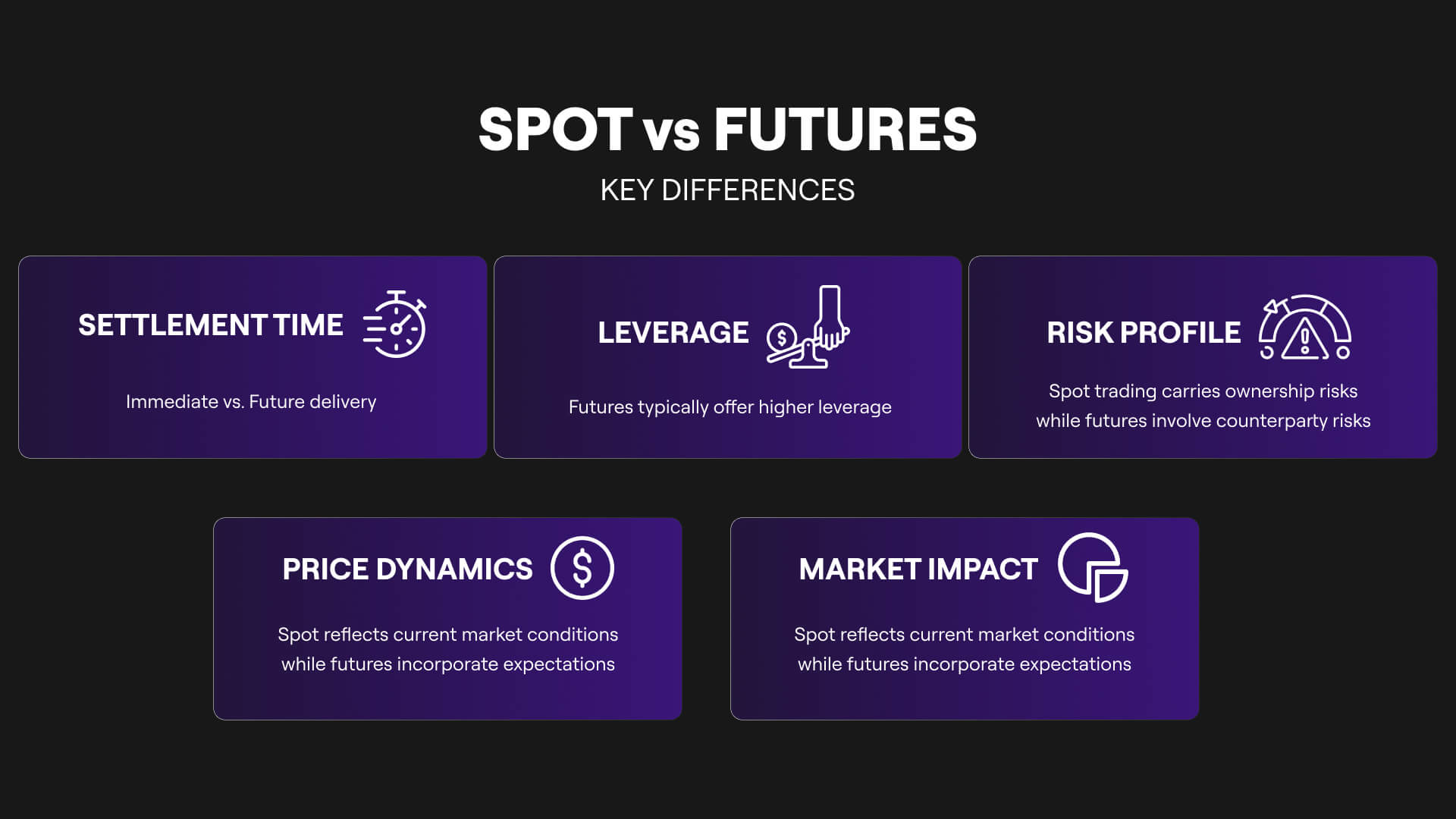

Spot vs Futures Markets

Spot markets enable immediate asset delivery - when you buy Bitcoin on an exchange, you gain immediate ownership and can transfer it to your wallet or use it right away.

Definition:

The crypto spot market is where cryptocurrencies are traded for immediate delivery. Prices here reflect real-time demand and supply dynamics, making it the backbone of the crypto ecosystem.

Example:

Buying Ethereum (ETH) at $1,800 for immediate transfer to your wallet is a spot market transaction.

Futures markets, on the other hand, involve contracts for future delivery at predetermined prices. While spot traders work with immediate settlement and direct ownership, futures traders can use higher leverage and trade contracts that expire on specific dates.

Definition:

The crypto futures market involves contracts to buy or sell cryptocurrencies at a predetermined price on a specific future date. These contracts enable traders to hedge risks or speculate on future price movements.

Example:

Selling a Bitcoin futures contract at $31,000 for delivery in one month locks in that price, regardless of market fluctuations. The relationship between these markets creates interesting dynamics. For instance, a Bitcoin spot price might be $50,000 while three-month futures trade at $52,000. This $2,000 difference, called the basis, reflects market expectations and creates opportunities for traders who can effectively work across both markets.

Price formation in these markets reflects countless factors: economic data, company performance, global events, market sentiment, and technical analysis. Traders analyze these elements to make informed decisions about when to enter or exit positions. Some focus on short-term price movements, completing many trades within a single day (day trading), while others hold positions for weeks or months (position trading).

How to Manage your Risk Level when Trading

Risk management plays a crucial role in trading success. Professional traders typically risk only a small percentage of their capital on any single trade and use tools like stop-loss orders to automatically exit positions if losses exceed predetermined levels. They also diversify their trading strategies and the assets they trade, reducing their exposure to any single market or type of risk.

In cryptocurrency markets, these traditional trading principles apply but operate within a unique technological framework. The blockchain technology underlying cryptocurrencies enables trading to happen directly between parties ( stocks peer-to-peer) without traditional financial intermediaries. This innovation has created new trading opportunities and challenges, setting the stage for sophisticated strategies like basis trading, which we'll explore in detail throughout this guide.

But before that, let's see some common trading strategies that diminish the risks of trading if well understood and put into practice:

Types of Trading Strategies

- Scalping: Trading that captures tiny price movements, often holding positions for seconds to minutes, executing hundreds of trades per day.

- Day Trading: Opening and closing positions within the same trading day.

- Swing Trading: Holding positions for days to weeks to capture medium-term price movements.

- Position Trading: Long-term trading spanning months to years, focusing on fundamental value.

- Directional Trading: Taking positions based on predicted price movements - either going long (buying) when expecting prices to rise or short (selling) when expecting them to fall.

- Market Making: Providing liquidity by simultaneously placing buy and sell orders, profiting from the spread between bid and ask prices.

- Statistical Arbitrage: Exploiting price differences of the same asset across different markets.

- Relative Value Trading: Trading correlated assets against each other. This might involve going long on Bitcoin while shorting other cryptocurrencies that typically move together.

- Basis Trading: This is actually a subset of relative value trading. It specifically involves trading the relationship between spot and futures prices of the same asset.

For example, a trader might buy Bitcoin at $50,000 and sell at $50,025 within minutes, repeating this process throughout the day.

A day trader might spot a morning trend in Ethereum and ride it for several hours before closing their position before the day ends.

A swing trader could buy during a market dip and sell after a recovery period of 1-2 weeks.

These traders might accumulate Bitcoin during bear markets, planning to sell during the next bull cycle.

For example, buying Bitcoin on an exchange where it's cheaper and selling it on another where it's more expensive.

What is Basis Trading?

In short: Basis trading is a strategic approach that capitalizes on the price difference between spot and futures markets. The "basis" represents the gap between current spot prices and future delivery prices of cryptocurrencies.

At its core, basis trading in cryptocurrency markets involves simultaneously taking positions in both the spot and futures markets to capture the difference between their prices. This price difference, known as the "basis," exists because futures contracts typically trade at a premium to the spot price – a phenomenon that creates opportunities for traders who understand how to harness it.

Let's break this down with a concrete example.

Imagine Bitcoin is currently trading at $29,800 on the spot market, while its one-month futures contract is priced at $30,200. This creates a basis of $400, an indicator of potential arbitrage. A trader observing this market difference might explore how to utilize this price discrepancy.

Basis Trading Mechanics:

Following the above given example, a trader would simultaneously buy Bitcoin in the spot market at $29,800 and sell the futures contract at $30,200. As the delivery date of the futures contract approaches, the basis naturally converges toward zero – a process known as basis convergence . When the futures contract expires, both prices must be equal, as a futures contract at expiration is essentially equivalent to spot delivery.

The beauty of this strategy lies in its market-neutral nature. Unlike directional trading, where profits depend on correctly predicting whether prices will rise or fall, basis trading can potentially generate returns regardless of market direction. Let's see how this works:

Scenario 1 - Price Rises:

- If Bitcoin's price rises to $32,000

- Spot position gain: $2,200 ($32,000 - $29,800)

- Futures position loss: -$1,800 ($30,200 - $32,000)

- Net profit: $400 (equal to the initial basis)

Scenario 2 - Price Falls:

- If Bitcoin's price falls to $28,000

- Spot position loss: -$1,800 ($28,000 - $29,800)

- Futures position gain: $2,200 ($30,200 - $28,000)

- Net profit: $400 (equal to the initial basis)

In both scenarios, the trader captures the $400 basis spread, demonstrating how this strategy can generate consistent returns regardless of whether the market moves up or down. This market-neutral characteristic makes basis trading particularly attractive during periods of high volatility or uncertain market direction.

However, executing basis trades requires careful consideration of several factors.

Basis Trading Factors you Must Take into Account:

The existence of a price difference between spot and futures markets isn't arbitrary - it reflects fundamental economic principles. The basis typically emerges from what's known as the cost-of-carry model, which accounts for the expenses and benefits of holding an asset over time.

In cryptocurrency markets, the primary factors contributing to the futures premium include:

Interest Rate Component: When traders buy cryptocurrency in the spot market, they need to lock up capital that could otherwise earn interest. The futures premium should theoretically compensate for this opportunity cost. For example, if risk-free interest rates are 5% annually, traders expect roughly this much premium in futures prices to compensate for their locked capital.

Storage and Security Costs: Unlike traditional commodities, cryptocurrencies don't have physical storage costs. However, they do incur custody costs like wallet security, insurance, and technical infrastructure. These costs get reflected in the futures premium.

Market Sentiment: The basis often exceeds the pure cost-of-carry in bullish markets as traders are willing to pay more for leverage through futures. During the 2021 bull market, Bitcoin futures sometimes traded at 15-20% annualized premiums, far above the theoretical cost-of-carry rate.

So, the basis itself fluctuates based on market conditions. During periods of extreme bullish sentiment, the futures premium might expand significantly, offering larger potential returns but also indicating higher market risk. Conversely, during bearish periods, the basis might contract or even turn negative (known as backwardation), presenting different types of opportunities for skilled traders.

Think of basis trading as similar to running a retail business where you buy products at wholesale prices and sell them at retail prices. The difference between these prices – your gross margin – is analogous to the basis in futures trading. Just as a retailer needs to consider various costs and risks while maintaining their profit margin, a basis trader must carefully manage their positions while protecting their expected return.

Basis Trading Tactics

Basis trading in cryptocurrency markets encompasses several strategies, each building upon fundamental market principles while introducing unique complexities and opportunities. Understanding these different methods helps traders choose strategies that best match their goals, resources, and risk tolerance.

Let me walk you through the progression from basic approaches to more sophisticated tactics:

Cash and Carry: The most straightforward basis trading approach is the cash-and-carry strategy, which we touched on earlier.

This approach involves buying an asset in the spot market while simultaneously selling it in the futures market. For example, if you observe Bitcoin futures trading at a 10% annualized premium, you could buy Bitcoin in the spot market and sell futures contracts. The key here is that your return is locked in at the moment you enter both trades, assuming you hold until expiration. This makes cash and carry fundamentally different from directional trading strategies, where returns depend on future price movements.

Perpetual Futures and Funding Rate Arbitrage

A more sophisticated approach involves trading the funding rate in perpetual futures markets. Unlike traditional futures that have an expiration date, perpetual futures contracts never expire. Instead, they use a funding rate mechanism to keep the perpetual price aligned with the spot price. Traders who understand this mechanism can profit from funding rate differentials while maintaining delta-neutral positions.

The strategy here involves watching for situations where funding rates become significantly positive or negative. When rates are highly positive, traders can short the perpetual future and buy the spot asset, earning the funding rate while staying market neutral. This approach requires more active management than traditional basis trading but can offer compelling returns in volatile markets.

Cross-Exchange Basis Trading

Perhaps the most complex approach is cross-exchange basis trading, where traders capture basis differences across multiple exchanges. This strategy requires sophisticated infrastructure to execute quickly and manage positions across different platforms. The premise is simple: find exchanges where the basis differs significantly, then buy the lower-priced basis and sell the higher-priced one.

For instance, if Exchange A shows a 12% annualized basis while Exchange B shows 8%, a trader could buy spot and sell futures on Exchange B while simultaneously selling spot and buying futures on Exchange A. This creates a pure arbitrage opportunity, though it requires careful management of exchange risks and transfer costs.

As futures contracts approach expiration, traders face strategic decisions about rolling positions. The choice between letting contracts expire or rolling to later dates depends on comparing basis levels across different expiration dates and calculating transaction costs for each approach.

Here's a List of 5 Practical Tips for Basis Trading

- Begin basis trading in markets with high liquidity in both spot and futures. Bitcoin and Ethereum typically offer the most reliable basis trading opportunities due to their market depth.

- Keep track of futures funding rates - they directly impact the profitability of basis trades. High funding rates often signal opportunities for basis strategies.

- Calculate Total Costs Factor in all trading fees, funding rates, and potential slippage when determining position sizes. Small price differences can quickly evaporate once costs are considered.

- Maintain balanced positions between spot and futures markets. Any mismatch exposes you to directional risk, defeating the market-neutral nature of basis trading.

- Manage your risk wisely:

i. Set clear exit points for when the basis widens instead of converging

ii. Use stops to protect against extreme market movements

iii. Never risk more than 1-2% of your trading capital on a single basis trade

iv. Monitor correlation breaks between spot and futures markets

Conclusion

The journey into basis trading represents an evolution in cryptocurrency trading sophistication. As we've explored throughout this guide, this strategy offers unique advantages - market neutrality, consistent returns, and reduced directional risk. However, success in basis trading demands more than just understanding price mechanics and market dynamics.

Remember that basis trading requires maintaining assets across multiple venues - spot markets, futures exchanges, and sometimes multiple platforms for cross-exchange opportunities.

This distribution of assets heightens the importance of robust security practices. While you focus on capturing basis spreads and managing trading risks, don't overlook the fundamental necessity of protecting your cryptocurrency holdings.

Professional traders often say that keeping your trading capital secure is just as important as generating returns. Even the most profitable basis trading strategy can be undermined by poor security practices. From proper key management to understanding the security features of different exchanges, protecting your assets should be your foundation before implementing any trading strategy.

To help you establish this crucial foundation, we've created a comprehensive guide on cryptocurrency security best practices. Our blog post, "How to Protect your Cryptocurrency from Scams," walks you through essential security measures, from hardware wallet selection to exchange security features that particularly matter for basis traders - a must-read before deploying any basis trading strategy.

As you begin your basis trading journey, remember that success comes from the combination of trading expertise and operational excellence. The opportunities in cryptocurrency markets are substantial, but they're best captured by traders who prioritize both strategic sophistication and robust security practices.

Your journey toward becoming a successful basis trader starts with securing your foundation on knowledge.

Join TOKERO Ventures to get the foundation you need!